kansas sales tax exemption certificate

If a Tax-Exempt Entity Exemption Certificate is obtained by the seller it can be used for. A more complete discussion of this exemption is provided in Notice 00-08Kansas Exemption for Manufacturing Machinery Equipment.

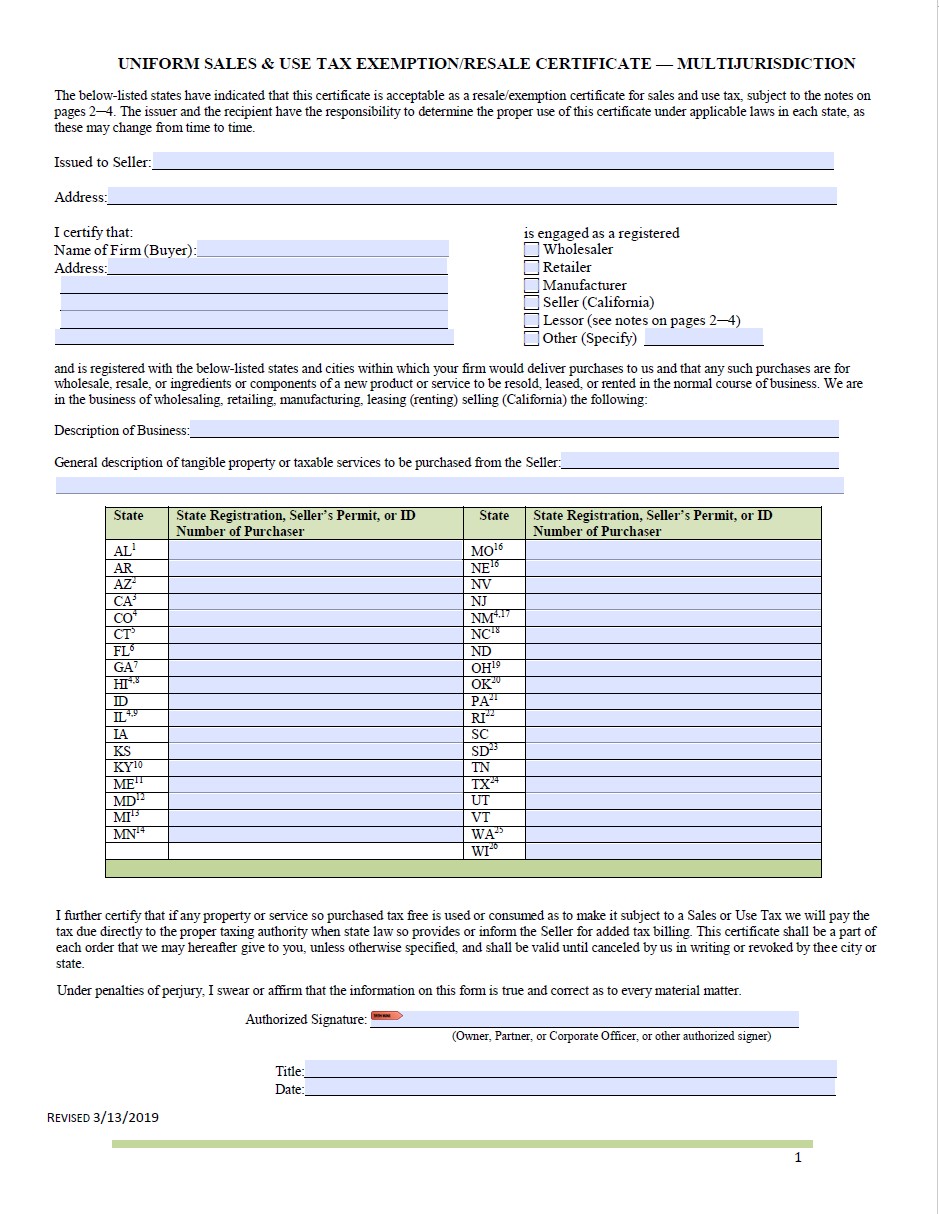

Kansas Exemption Certificate Form Fill Out And Sign Printable Pdf Template Signnow

Local sales rates and changes.

. Therefore you can complete the resale exemption certificate form by providing your Kansas Sales Tax Registration Number. Destination-based sales tax information. Ad New State Sales Tax Registration.

Ad 1 Fill out a simple application. Ad Register and Edit Fill Sign Now your KS ST-28A Form more fillable forms. Ad Register and Subscribe Now to work on your KS Resale Exemption Cert more fillable forms.

Sales Tax Entity Exemption Certificate Renewal On November 1 2014 the sales tax exemption certificate issued by the Kansas Department of Revenue will expire. For tax assistance consult our website or call the. 2 Get a resale certificate fast.

2 Get a resale certificate fast. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for. Most exemptions from sales tax require a buyer to present an exemption certificate and the exemption is to be on file in the selling department to avoid the collection.

All construction materials and prescription drugs including prosthetics. You can download a. You can download a.

1320 Research Park Drive Manhattan Kansas 66502 785 564-6700 The information contained in this handbook is for informational purposes only and is to be used as a resource. Your Kansas Tax Registration Number. 79-3606fff exempts all sales of material handling equipment racking systems and other related machinery and equipment used for the handling movement or storage of tangible.

79-3606fff exempts all sales of material handling equipment racking systems and other related machinery and equipment used for the handling movement or storage of tangible. How to use sales tax exemption certificates in Kansas. In Kansas certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers.

A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the Kansas sales tax. Ad 1 Fill out a simple application. This exemption certificate is used either to claim a sales and use tax-exemption present in Kansas law not covered by other certificates or by a non-Kansas tax-exempt entity not in.

Kansas Sales Tax Exemption Certificate information registration support. A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the Kansas sales tax. As a reminder if you question the validity of an exemption certificate you can check on a tax entity exemption certificate through a verification process on our web site.

File withholding and sales tax online. Exemption Certificate Enter your Sales or Use Tax Registration number and the Exemption Certificate number you wish to verify. This sales tax exemption is in the Kansas Department of Revenues Notice 00-08 Kansas Exemption for Manufacturing Machinery Equipment as Expanded by KSA.

All Tax-Exempt Entity Exemption Certificates sample shown on page 15 contain an expiration date. Effective July 1 2022 purchasers which includes contractors may use this certificate to purchase tangible personal property necessary to construct reconstruct repair or replace any fence. Once you have that you are eligible to issue a resale certificate.

Fillable Online Baldwincity Kansas Department Of Revenue Baldwincityorg Fax Email Print Pdffiller

Reg 256 Fillable Forms Facts Form

Kansas Tax Exempt Form Pdf Fill Online Printable Fillable Blank Pdffiller

Fillable Online Kansas Sales And Use Tax Exemption Certificate Um Infopoint Fax Email Print Pdffiller

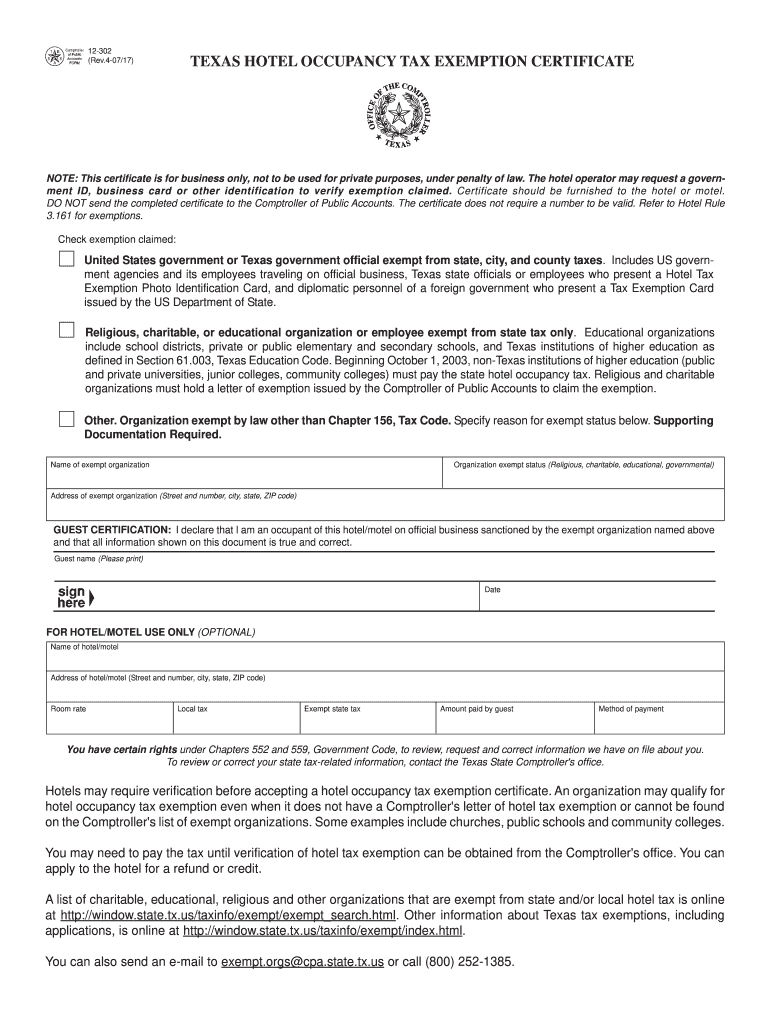

Form 12 302 Fillable Texas Hotel Occupancy Tax Exemption Certificate Fill And Sign Printable Template Online Us Legal Forms