cap and trade vs carbon tax upsc

Theory and practice Robert N. It is a cost-effective tool to reduce.

-A Carbon Tax will provide greater efficiency and transparency than a Cap-and-Trade.

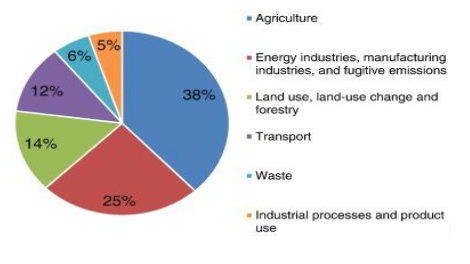

. Economic guru and former Federal Reserve Chairman Alan Greenspan has come out against cap and trade as an effective mechanism for reducing carbon emissions. CARBON TAXESExxons CEO call for a carbon taxThe chief executive of Exxon Mobil Corp. The cap and trade system is thus functionally similar to a tax on carbon.

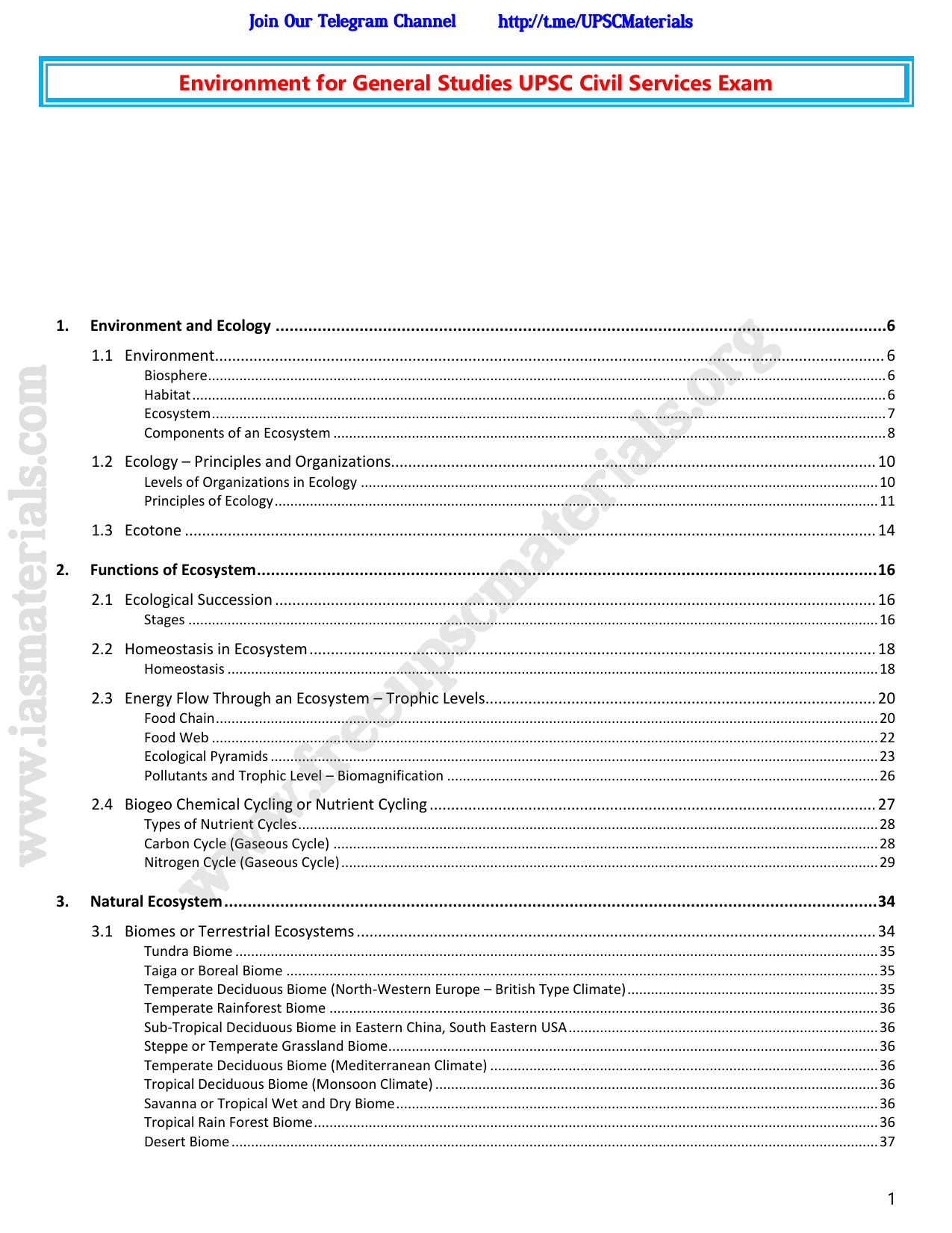

The most often cited benefits and drawbacks of each system can be surmised as follows. The price of the carbon is determined by assessing the cost of damage associated with each unit of pollution and the cost of controlling that pollution Grantham. Several Chinese cities and.

April 9 2007 413 pm ET. This can be implemented either through a carbon tax known as a price instrument or a cap-and-trade scheme a so-called quantity instrument. Carbon Tax vs.

Environmental Defense chief scientist Bill Chameides wrote a piece in Gristmill as well laying out the case for a cap and. A carbon tax and cap and trade are two ways that damages can be paid for. Additionally our experiment showed that emissions were 117 percent lower under the cap-and-trade scenario.

They have many similarities some tradeoffs and a few key differences. For example European countries have operated a cap-and-trade program since 2005. This was partly due to lower production volume overall but the.

Prime Minister Justin Trudeau announced a new nation-wide 10 per tonne carbon tax that will start in 2018 -- a price that will rise by 10 per year topping out at 50 by 2022. I am opposed however. Michael OHare responded with a heated defense of carbon taxes or as he calls them carbon charges premised mainly on a basic misunderstanding of Romms post.

Carbon taxes vs. Stavins1 Harvard Kennedy School This paper compares the two major approaches to carbon pricing carbon. A carbon tax imposes.

Carbon trading allows countries and companies to. The basic idea of a cap-and-trade system is to control carbon emissions by creating a regulated marketplace in which polluters can buy and sell emissions while adhering. It levies a fee on the production distribution or use of fossil fuels based on how much carbon their combustion emits.

We examine the relative attractions of a carbon tax a pure cap-and-trade system and a hybrid option a cap-and. For the first time called on Congress to enact a tax on. Today cap and trade is used or being developed in all parts of the world.

Under the prevailing Kyoto Protocol climate agreement carbon credits are used in market-based system of Carbon Trading. Indeed in stable world with perfect information cap and trade would be exactly equivalent to a carbon. It is a form of Pollution Tax.

Money from the carbon tax could go to renovating infrastructure to make buildings more economical. Issue Date August 2013. Organizations in favor of a cap and trade system.

Cap and trade or emissions trading is a common term for a government regulatory program designed to limit or cap the total level of specific chemical by-products. It seems inevitable that some day Congress will pass legislation meant to cut greenhouse-gas. Indeed both cap-and-trade and carbon taxes are good approaches to the problem.

Carbon Credit Carbon Sequestration Carbon Tax And Carbon Offsetting Youtube

Insights Daily Current Affairs Pib Summary 15 July 2021 Insightsias

Upsc Dna 24th Jan 2015 Gs Today

Carbon Credit Carbon Sequestration Carbon Tax And Carbon Offsetting Youtube

Pmfias Environment Notes 2019 Freeupscmaterials Org

A Case For A Differential Global Carbon Tax Gs 3 Empower Ias Empower Ias

Carbon Credit Carbon Sequestration Carbon Tax And Carbon Offsetting Youtube

Carbon Tax Vs Cap And Trade Vs Carbon Credit Vs Carbon Pricing Difference 1 2 Youtube

Carbon Tax And Its Impact On India Ipleaders

The Big Picture Carbon Border Tax

A Case For A Differential Global Carbon Tax Gs 3 Empower Ias Empower Ias

Upsc Prelims 2021 Analysis By Ias Corridor Pdf Fiscal Policy Economics